Stakeholder Divisions Hang Over Section 101 Reform Efforts as Supreme Court Winnows Alice Appeals

The Supreme Court’s Alice decision once provided a key offramp for defendants hoping to challenge patent eligibility, but subsequent decisions have narrowed their ability to succeed with such motions in the early stages of district court litigation. Meanwhile, the ever-expanding body of caselaw applying Alice has remained a point of contention for some stakeholders. As the Supreme Court considers one prominent Alice appeal, disagreements over the proper scope of Section 101 have been reflected in recent public commentary and have spilled over into Congress as legislators ponder reforms. Here, RPX takes a closer look at those tensions and provides a breakdown of the latest data on patent eligibility.

American Axle: Justices Await Solicitor General’s Brief in Closely Watched Appeal

The Supreme Court has consistently declined to revisit the topic of patent eligibility since Alice, despite the ongoing debate spurred by courts’ subsequent application of that decision’s rationale. Indeed, the Court has regularly continued to deny lower-profile petitions for certiorari challenging various aspects of the Alice test this year—most recently, rejecting three petitions in October alone, in ENCO Systems v. DaVincia, iLife Technologies v. Nintendo, and VoIP-Pal v. Apple.

However, one particularly high-profile Supreme Court petition remains pending: the appeal of the Federal Circuit’s controversial decision in American Axle & Manufacturing v. Neapco, which has ignited a heated debate over the bounds of Section 101 jurisprudence. In American Axle, a divided Federal Circuit found that a patent related to a quieter automotive driveshaft was unpatentably directed to a natural law, Hooke’s Law, in contrast to decisions like Diamond v. Diehr that found a mechanical process implementing a natural law to be eligible. The full Federal Circuit was split 6-6 on whether to rehear the panel decision—falling short of the threshold for en banc review.

In May, the Supreme Court issued a Call for the Views of the Solicitor General (CVSG) in American Axle, usually a sign that the Court is giving an appeal particularly close consideration. The resulting brief could come as early as December should the Solicitor General seek to tee the case up for oral arguments by the end of April. This is the first time that such a brief has been requested in a 101 case under the Biden administration; during the Trump years, the Solicitor General recommended that the Court grant a petition in a medical diagnostics case (Athena), though the Court declined to do so.

A variety of stakeholders have also submitted amicus briefs in that case—notably, including one cofiled by Senator Thom Tillis (R-NC), former Federal Circuit Judge Paul Michel, and former USPTO Director David Kappos, as well as others from the academic community, business trade associations, and the NYIPLA.

Legislative Reform Faces an Uphill Climb

2021 has also seen Congress focus renewed attention on Section 101 reform. In March, Senator Tillis and three other members of the Senate IP Subcommittee—Senators Tom Cotton (R-AR), Christopher Coons (D-DE), and Mazie Hirono (D-HI)—sent a letter to Acting USPTO Director Drew Hirshfeld, stating that it was “past time that Congress act to address this issue” and asking for his assistance as they “consider what legislative action should be taken to reform our eligibility laws”. To that end, the senators asked that Hirshfeld “publish a request for information on the current state of patent eligibility jurisprudence in the United States, evaluate the responses, and provide [them] with a detailed summary of [his] findings”—with an emphasis on current caselaw’s adverse impact on “investment and innovation in critical technologies like quantum computing, artificial intelligence, precision medicine, diagnostic methods, and pharmaceutical treatments”.

The USPTO published that request for comment in July, subsequently extending the September 7 deadline to October 18. The resulting comments—totaling over 140—reflect the divide between technology and life sciences companies. Even within the tech industry, opinions diverged among larger companies with substantial R&D and patenting activity: some argued that their investment and innovation in emerging technologies has actually increased in the current climate, while others have argued that the current uncertainty observed in patent eligibility jurisprudence makes obtaining and enforcing patents more expensive, negatively impacting innovation.

Opposition to the current eligibility regime was more uniform in the life sciences arena, however. For example, the Intellectual Property Owners Association (IPO) stated that its members widely agree on “the negative impact our colleagues in bio/pharma have seen to precision medicine, pharmaceutical treatments, and diagnostic methods”. The Biotechnology Innovation Organization (BIO), moreover, noted that innovation in these spaces “has been jeopardized by the uncertainty and doctrinal drift in the area of subject matter eligibility”, and asserted that the lack of predictability in biopharma patenting raised a significant question of whether investment in the space could continue.

Legislators have acknowledged that this lack of consensus makes it a difficult proposition to arrive at a patent eligibility reform proposal with wide enough support. This divide caused a prior reform push to hit a wall in 2019 after stakeholders in the life sciences and tech industries failed to agree on what to include in the proposed bill. Indeed, the month after sending the March 2021 letter to the USPTO noted above, Senator Tillis remarked that a legislative revamp of Section 101 was the “hardest” option compared to Supreme Court intervention: “Congressional action takes time and it requires a lot of consensus. And while I’m willing to legislate in this area if needed, it will take a while. For some industries and for emerging technologies, I worry time isn’t on their side”.

Data Update: Fewer Early Eligibility Challenges Being Granted

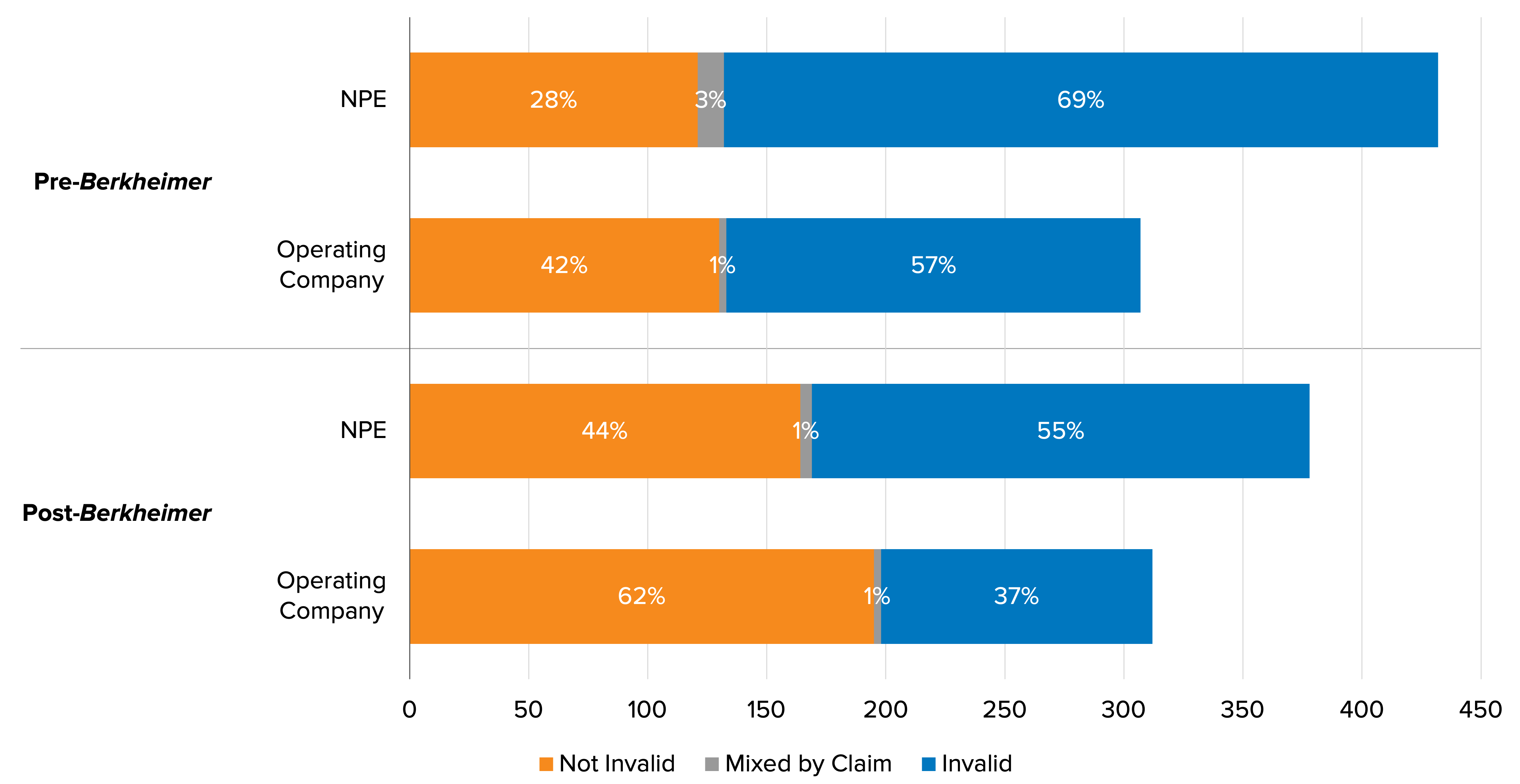

Congressional reform efforts notwithstanding, Alice currently remains in a narrowed state as a result of the Federal Circuit’s 2018 Berkheimer and Aatrix decisions, which limited courts’ ability to grant early patent eligibility challenges when a patent owner raises a factual dispute. The result has been a significant drop in the Alice invalidation rate that has since become the status quo for defensive eligibility motions, impacting both challenges against patents asserted by NPEs and by operating companies. In particular, as shown below, NPE patents challenged and adjudicated under Alice had a 69% invalidation rate before Berkheimer, but that dropped to 55% for patents with Alice decisions issuing since then. The invalidation rate dropped even further for patents asserted by operating companies, from 57% to 37%.

Patents Invalidated Under Alice Before and After Berkheimer by Plaintiff Type

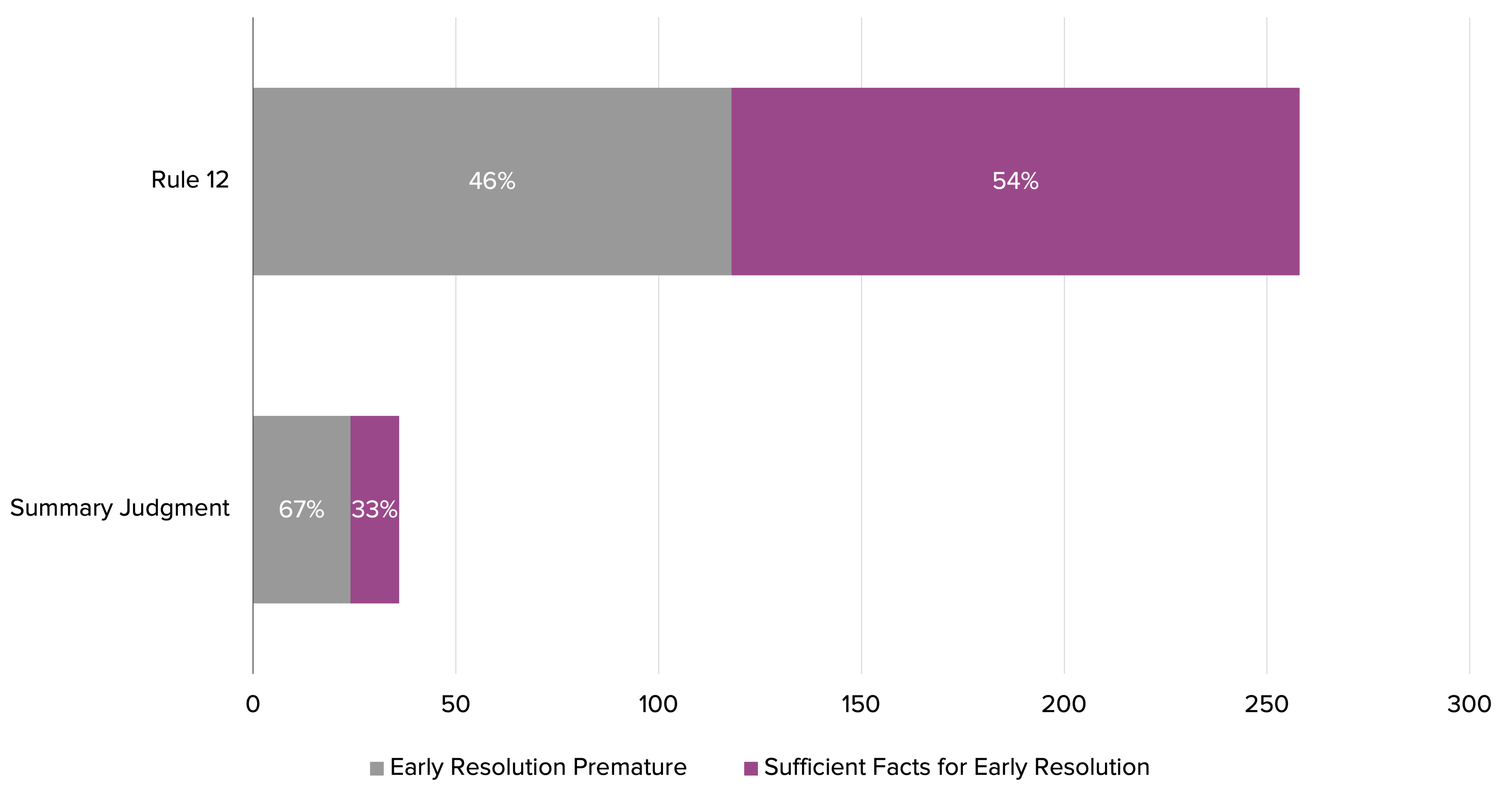

RPX data also indicate that plaintiffs succeed far less often when trying to use Berkheimer as a defense to block an Alice ruling at the Rule 12 stage (generally, those decided earlier in litigation) than at summary judgment. An analysis limited to decisions that turned on Berkheimer or Aatrix, meaning a plaintiff asserted that a factual issue precluded early resolution and the court’s order actually addressed that issue, shows that courts found sufficient facts to rule 54% of the time for Rule 12. However, for summary judgment decisions turning on Berkheimer, courts found that they had sufficient facts to move forward just 33% of the time.

Patents with Alice Orders Addressing Berkheimer by Procedural Stage

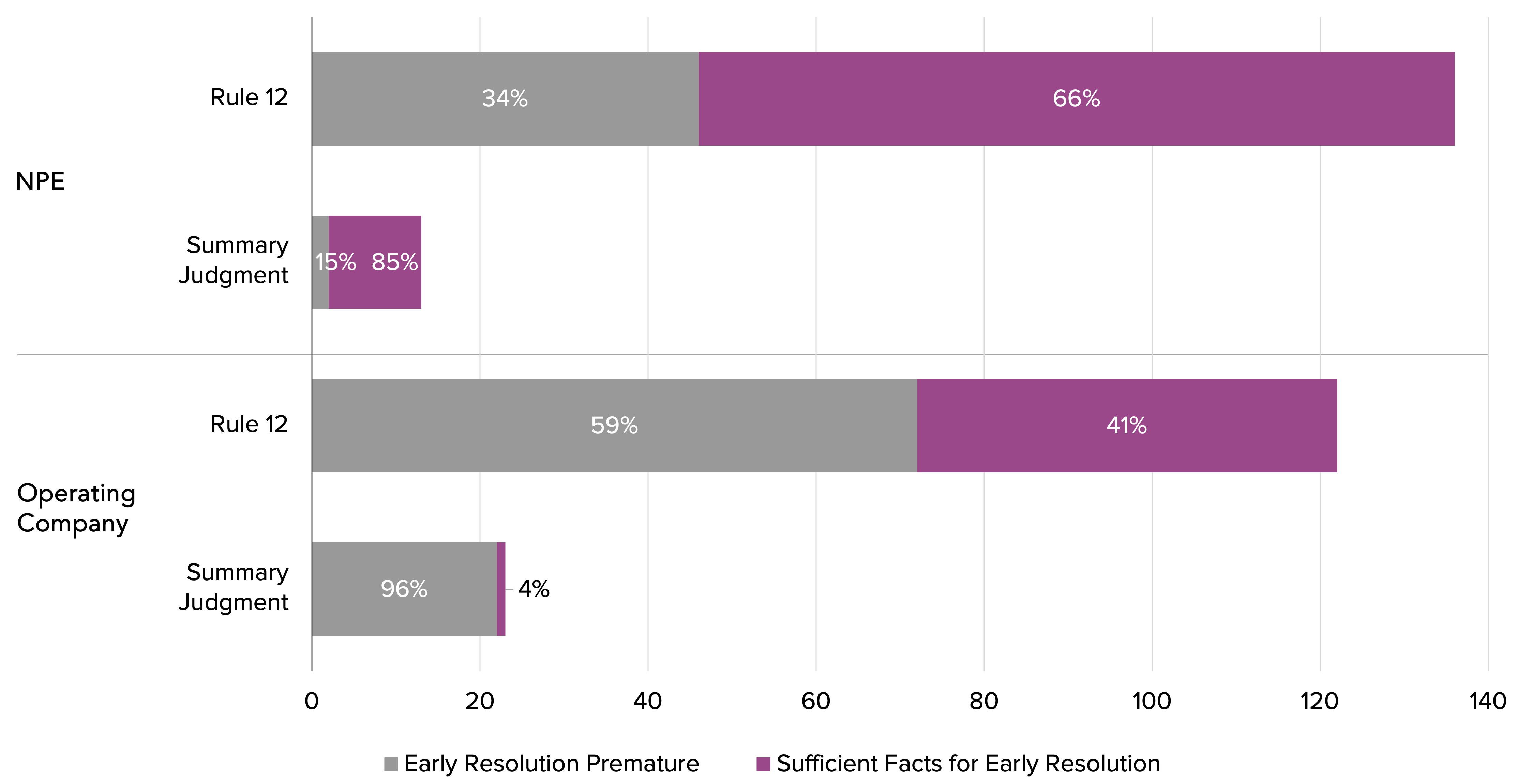

Moreover, adding a filter for plaintiff type reveals that NPEs are still much less successful than operating companies at blocking Rule 12 challenges under Berkheimer/Aatrix. As of the end of Q3, courts have found sufficient facts to issue a ruling 66% of the time for Rule 12 motions against NPEs but 41% of the time for those against operating companies. NPEs fare even worse at the summary judgment stage, as courts found sufficient facts to rule in 85% of Alice summary judgment motions against NPEs—while for summary judgment motions against operating companies, courts found sufficient facts just 4% of the time.

Patents with Alice Orders Addressing Berkheimer by Procedural Stage and Plaintiff Type

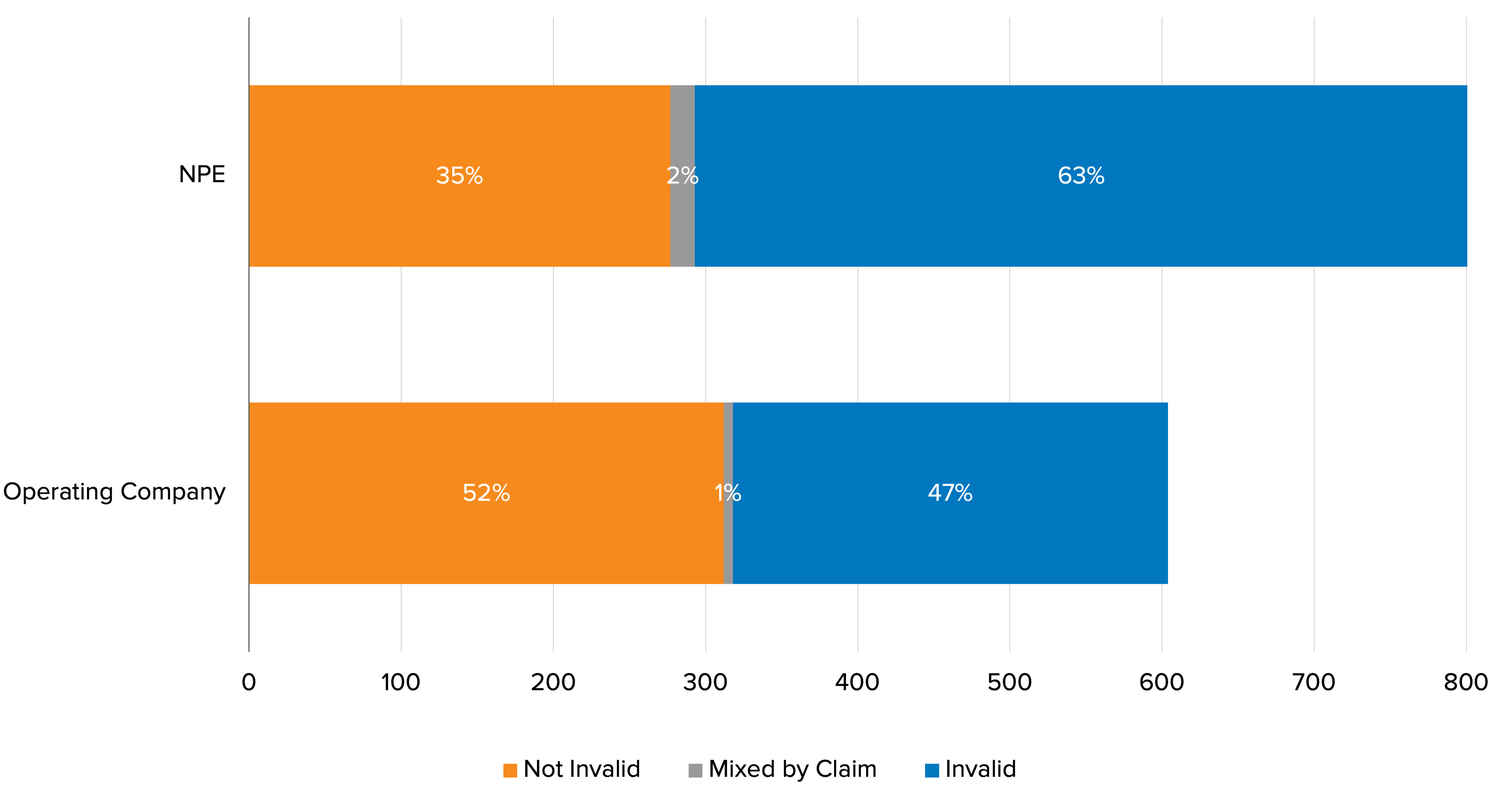

Overall, since the Alice decision’s June 2014 issue date and through the end of Q3 2021, 57% of patents have had claims invalidated under its rationale. Patents asserted by operating companies have fared better during that period, with 47% surviving Alice challenges—whereas those wielded by NPEs had an invalidation rate of around 63%.

Patents Invalidated Under Alice Since the Decision’s Issuance

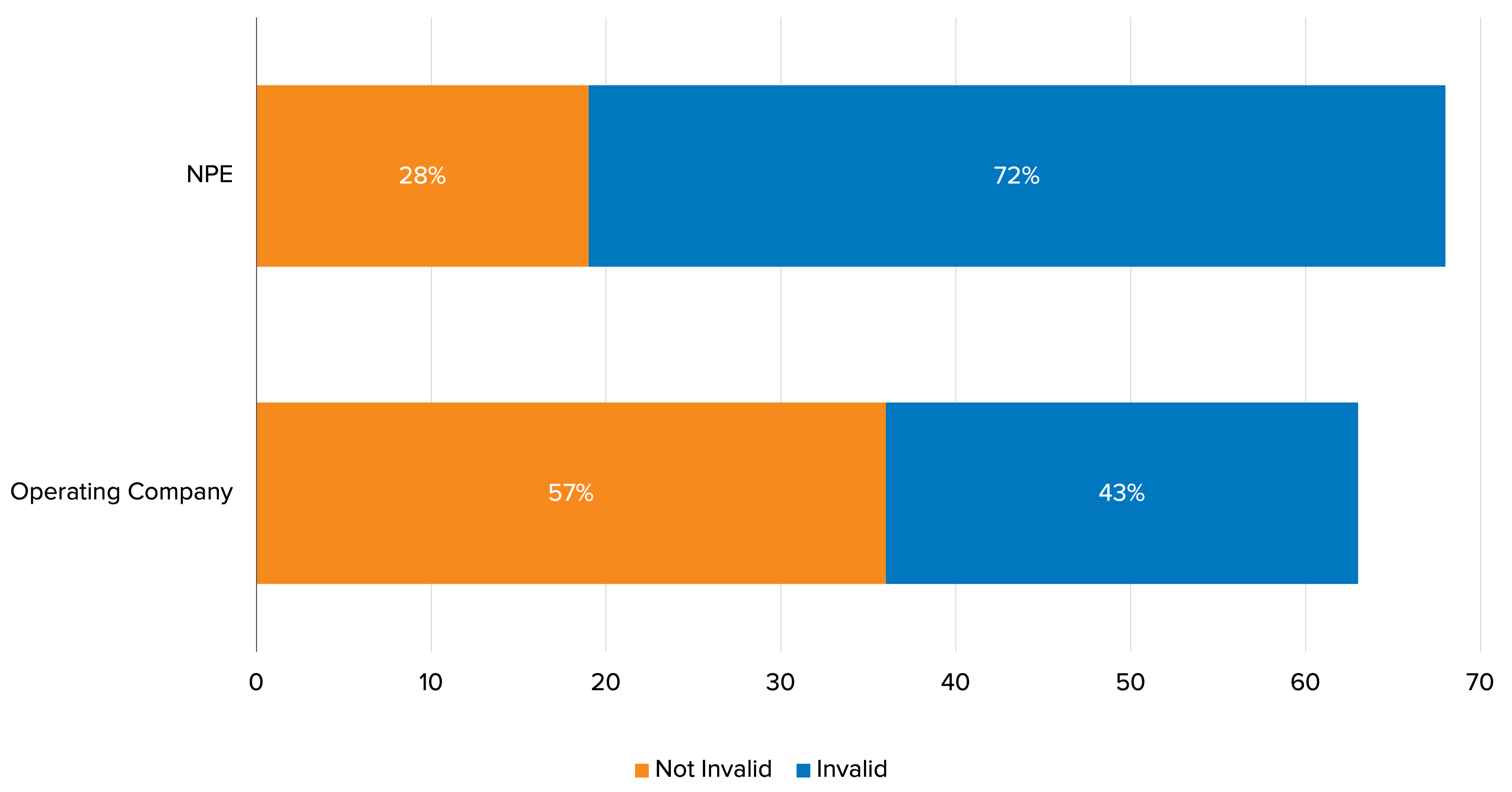

The gap was even wider for patents adjudicated in 2021 through the end of the third quarter. During that period, NPE patents were invalidated 72% of the time, compared to 43% for patents asserted by operating companies.

Patents Invalidated Under Alice in Q1-Q3 2021

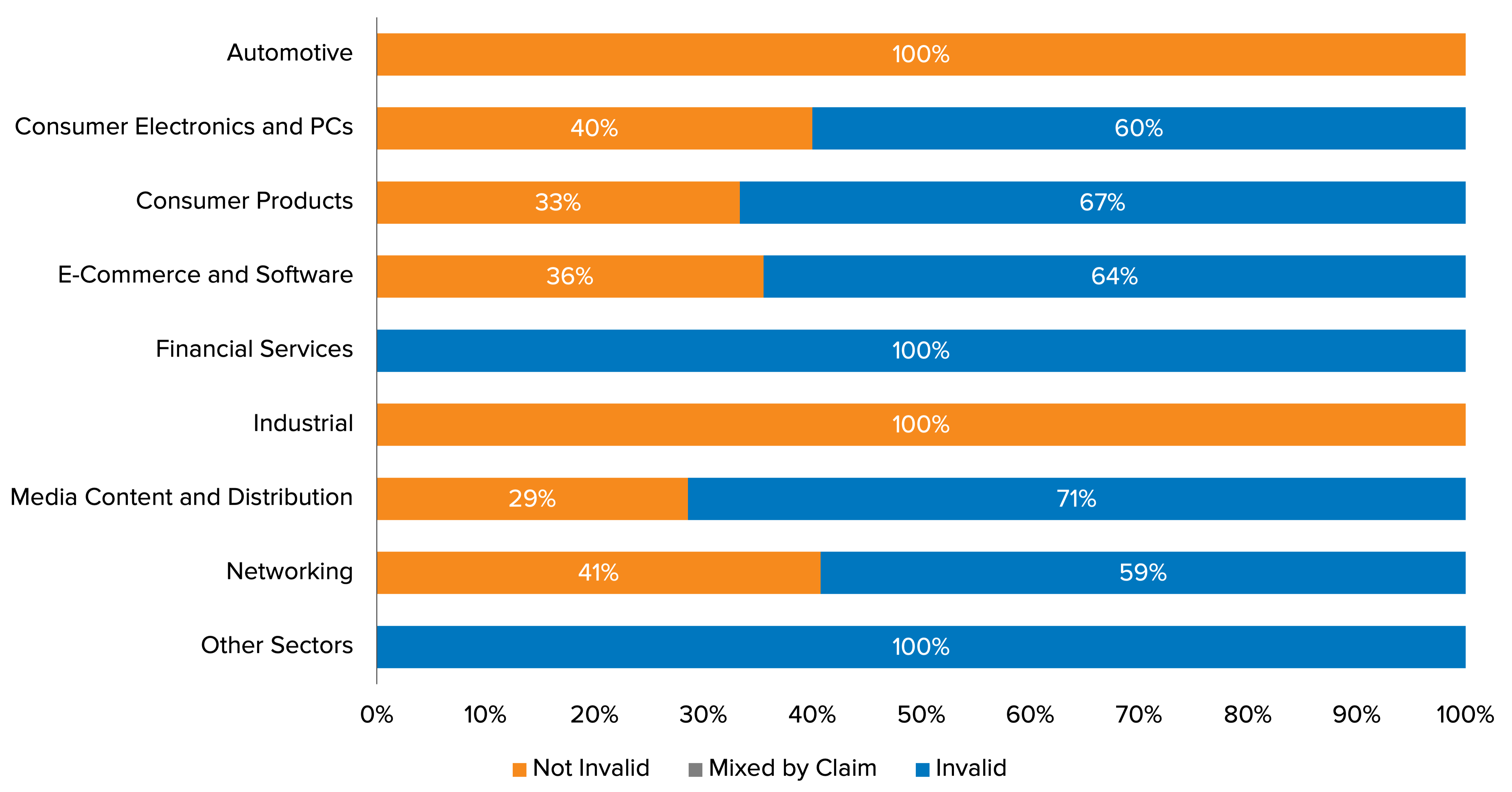

Additionally, a breakdown of invalidation rates by market sector (specifically, by the RPX market sector assigned to the litigation in which the patents were asserted and then challenged under Alice) reveals the industries with the most Alice activity in 2021 through Q3. During that period, the E-Commerce and Software sector again saw the most Alice decisions on a per-patent basis, with 76 patents adjudicated and an invalidation rate of 64%. The Networking sector was in second place with 27 patents adjudicated, with a 59% invalidation rate. Third was the Consumer Electronics and PCs sector, with 20 patents adjudicated and a 60% invalidation rate. Meanwhile, courts ruled on the eligibility of just seven patents asserted in Media Content and Distribution litigation, with five held invalid (or 71%). Sectors with even fewer challenges decided included Automotive, with four patents all surviving Alice; four patents asserted in the Industrial space also held to be not unpatentable; two of three Consumer Products patents both invalidated; and one Financial Services patent ruled to be invalid.

Alice Invalidation Rates by Market Sector for Motions Decided in Q1-Q3 2021