What 15 Years of US Patent Litigation Data Reveal About the IP Market

Patent litigation trends have been volatile over the last 15 years, often responding to legislative, administrative, and judicial changes. A disaggregation of this data reveals meaningful differences among plaintiff types and may provide valuable insight into the IP market today—and tomorrow.

Total patent litigation more than doubled from 2005 to a peak in 2011-2012 but has halved since then. Most of that long-term trend has been driven by NPE activity.

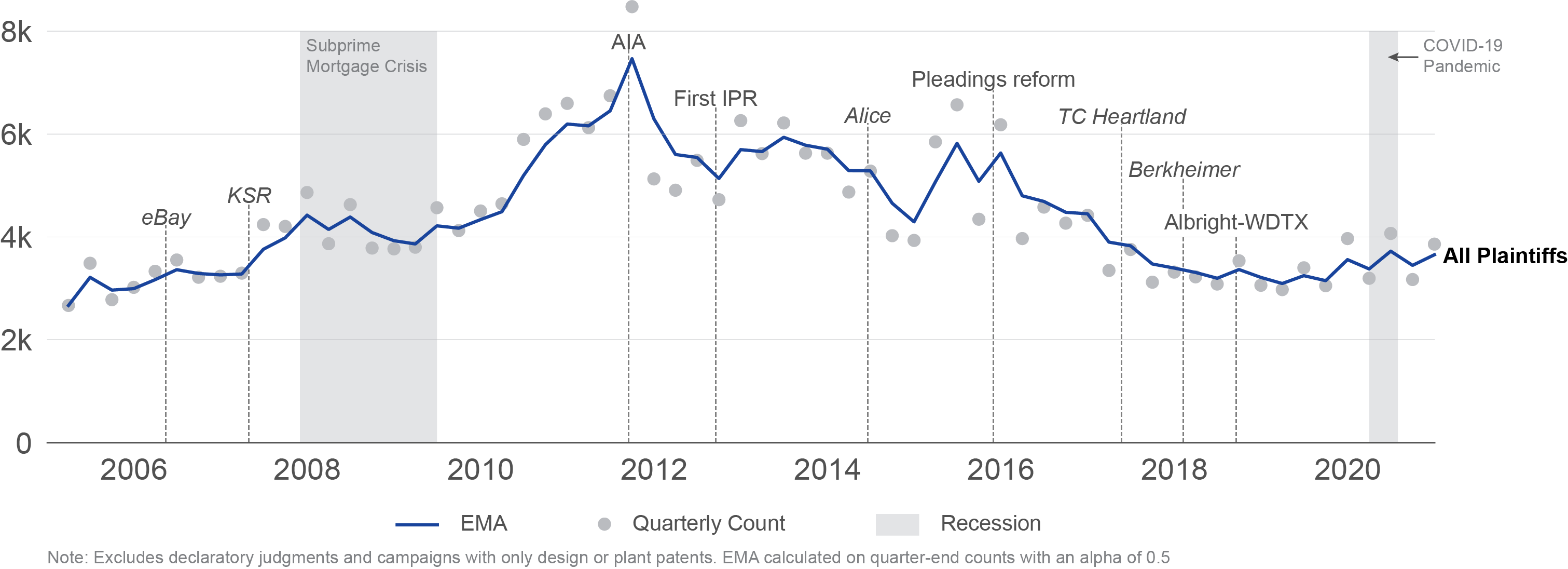

Figure 1 plots the count of defendants named in district court patent infringement cases filed by all plaintiff types from 2005 through 2020. The light gray dots are the annualized number of new defendants added to cases in each quarter (i.e., the quarterly count of defendants multiplied by four). The blue line is an exponential moving average (EMA) that smooths the quarterly fluctuations.

Figure 1. Quarterly Defendants (Annualized) Since 2005 – All Plaintiff Types

2020 finished with just under 3,600 defendants added to patent cases—a bit less than half the peak run-rate achieved in 2011 (≈8,000 defendants) just before the passage of the America Invents Act (AIA) and generally in line with the trend since 2018.

NPE Litigation

Compared to 2019, defendants added to litigation by NPE plaintiffs in 2020 is up about 9% (excluding about 34 declaratory judgment actions and a dozen cases involving only design patents).

Most of that increase can be attributed to two particular NPE plaintiffs: IP Edge LLC, the most active NPE in the past ten years, which added approximately 550 defendants to litigation in 2020, an increase of around 150; and new litigant WSOU Investments, LLC (d/b/a Brazos Licensing and Development), which added over 130 defendants in 2020.

IP Edge and WSOU Investments have taken different approaches to litigation. IP Edge (historically, a file-and-settle NPE wielding patents from a broad range of sources) filed about 550 complaints in 2020 against roughly 500 unique defendants. On the other hand, WSOU (an NPE asserting subsets of over 4,000 patent assets received from Nokia) has targeted a much smaller group of unique defendants (15 as of December 31, 2020), but has pummeled each with a barrage of cases, most involving only a single patent.

RPX data indicate that roughly 70% of IP Edge cases terminate within 180 days of filing, with reported settlement amounts typically an order of magnitude lower than the cost of an inter partes review (IPR) (see, e.g., here)—suggesting that the NPE has adopted a business model of seeking settlement amounts that make an IPR challenge by defendant-petitioners economically unattractive.

While apparently “flying under” the expense of IPRs, the impact of IP Edge’s growing patent portfolio on the NPE market should not be underestimated. In 2020 alone, the firm—which is responsible for 25% of all defendants added to NPE litigation during the year—received over 700 US assets, and many more foreign assets, from Technicolor SA in a transaction that followed acquisitions earlier in the year from Beamz Interactive, Allied Inventors Management, LLC, Ghost Telecom Limited, Huawei, Xerox, and a litigating subsidiary of IPValue Management (d/b/a IPValue).

NPEs and COVID-19

Unlike operating companies facing unprecedented business disruption as a result of the global pandemic, NPEs exist solely to monetize patents, and as such, may be far less affected. From a purely practical standpoint, COVID-19 has not required NPEs—which are usually staffed by a small team of professionals—to make drastic changes to their everyday business operations (though some NPEs, such as Quarterhill Inc., have reported slower deals).

Furthermore, NPEs backed by third-party litigation funders stand to weather, or even flourish in, the current economic environment. As discussed in more detail below, the patent marketplace has lately been teeming with former operating company patents, and in partnership with litigation funders, NPEs may begin picking up larger patent portfolios, possibly of higher pedigree—portfolios that prior to the COVID-19 recession may have been out of their reach.

Operating company patent litigation has been on a gentle downtrend since 2005.

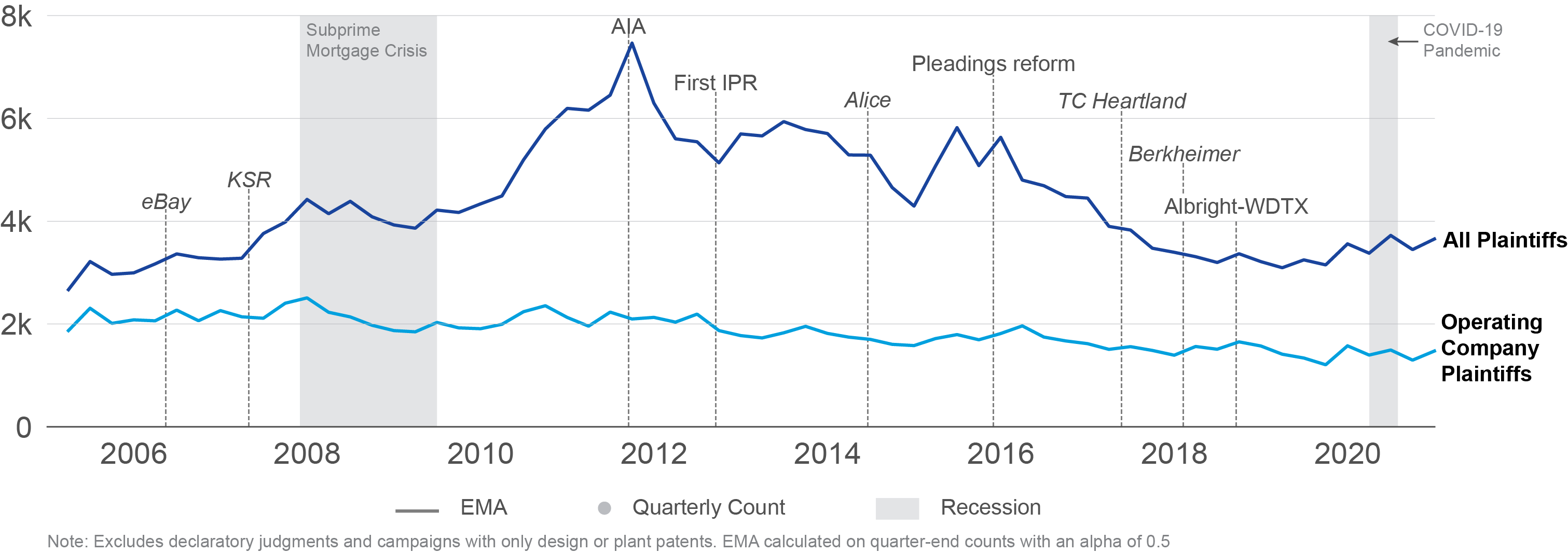

Figure 2 plots defendants added to litigation since 2005 by all plaintiffs and operating company plaintiffs only. From 2005 through 2012, operating company patent litigation held steady at an annual rate of just above 2,000 defendants; since then, it has been on a gentle, steady decline, finishing 2020 with about 1,460 defendants added, almost identical to the level in 2019. (These data exclude cases involving only design patents, which named nearly 3,000 defendants, mostly online merchants).

Figure 2. Quarterly Campaign Defendants (Annualized) Since 2005 – OpCo Plaintiffs

Reforms enacted over the past several years have had notable and measurable effects on NPE behavior; on the other hand, any effects on operating company plaintiff behavior are less obvious.

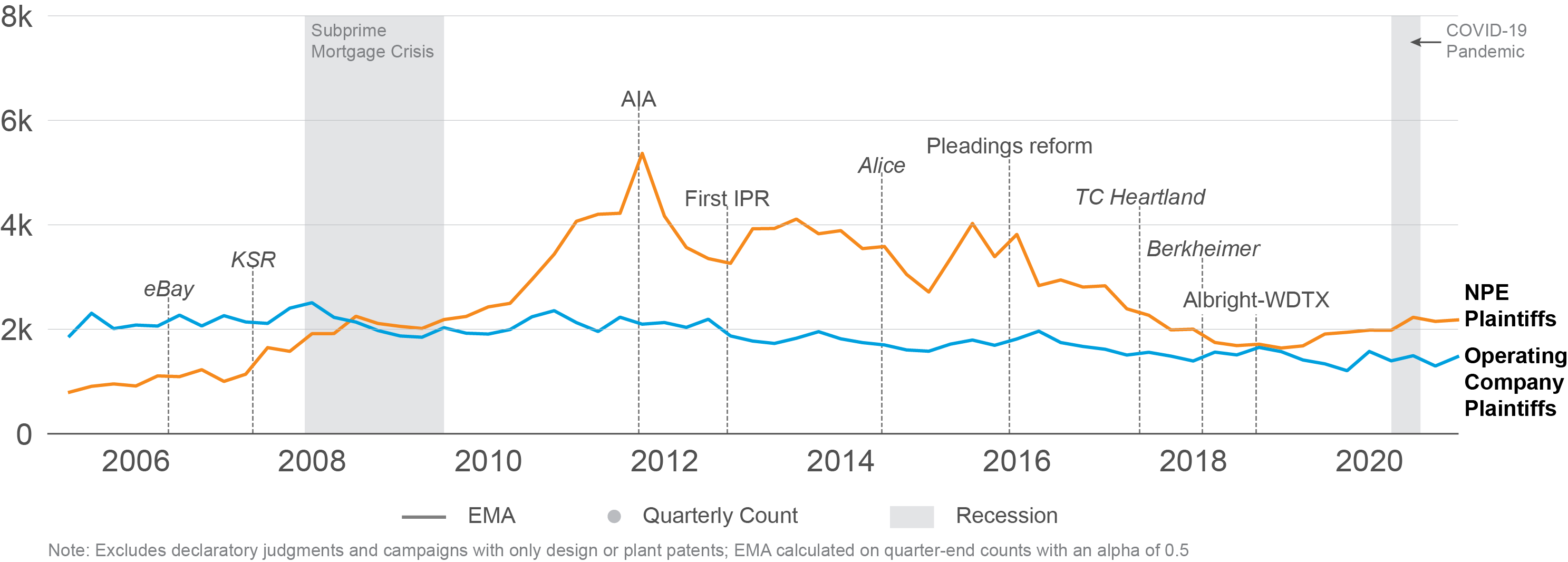

The most pronounced changes in the long-term litigation trends have been almost entirely driven by the behavior of NPE plaintiffs.

As illustrated in Figure 3, NPE litigation quintupled from an annualized rate of about 1,000 defendants in 2005 to a peak of nearly 5,000 in 2011 just before joinder reform took effect in September of that year. From there, the trend shows a general decline with some notable peaks and valleys—apparently in reaction to various reforms designed to deter some aspects of NPE behavior. For example, a notable spike in NPE complaints preceded joinder reform in 2011, whereas a lull in new NPE filings followed the Supreme Court’s Alice decision in 2014. Finally, late 2015 saw an NPE rush to the courthouse just ahead of pleadings reform.

Figure 3. Quarterly Campaign Defendants (Annualized) Since 2005 – NPE Plaintiffs v. OpCo Plaintiffs

This volatility stands in marked contrast to the trend-line for operating company litigation, which shows little change in anticipation of, or response to, some of the most significant reforms and decisions. To the extent that some of the reforms over the past decade were designed to address some aspects of NPE behavior, they seem to have been both effective and surgical in their application.

Economic slowdowns appear to be associated with patent divestments by operating companies in the subsequent years—often to NPEs.

The Great Recession of 2008 appears to have acted as a catalyst for operating companies to divest patents to NPEs. A look back at that period suggests that some operating companies divested patent assets because they were experiencing financial distress or because they were looking for new revenue streams amid the difficult economy. Some companies divested assets in connection with the M&A activity that has historically occurred in connection with economic downturns and recoveries.

As recently reported by RPX, the current financial crisis will likely be followed by a period of increased patent divestments by operating companies. Indeed, many patent holders—including operating companies and universities—are currently facing increased pressure to preserve and augment their cash balances. Many may turn in the coming year to their patent portfolios as a source of revenue by selling patent assets to NPEs, entering into privateering partnerships with NPEs, and/or by monetizing their own assets directly through licensing or litigation. Consequently, a rise in NPE litigation may follow.

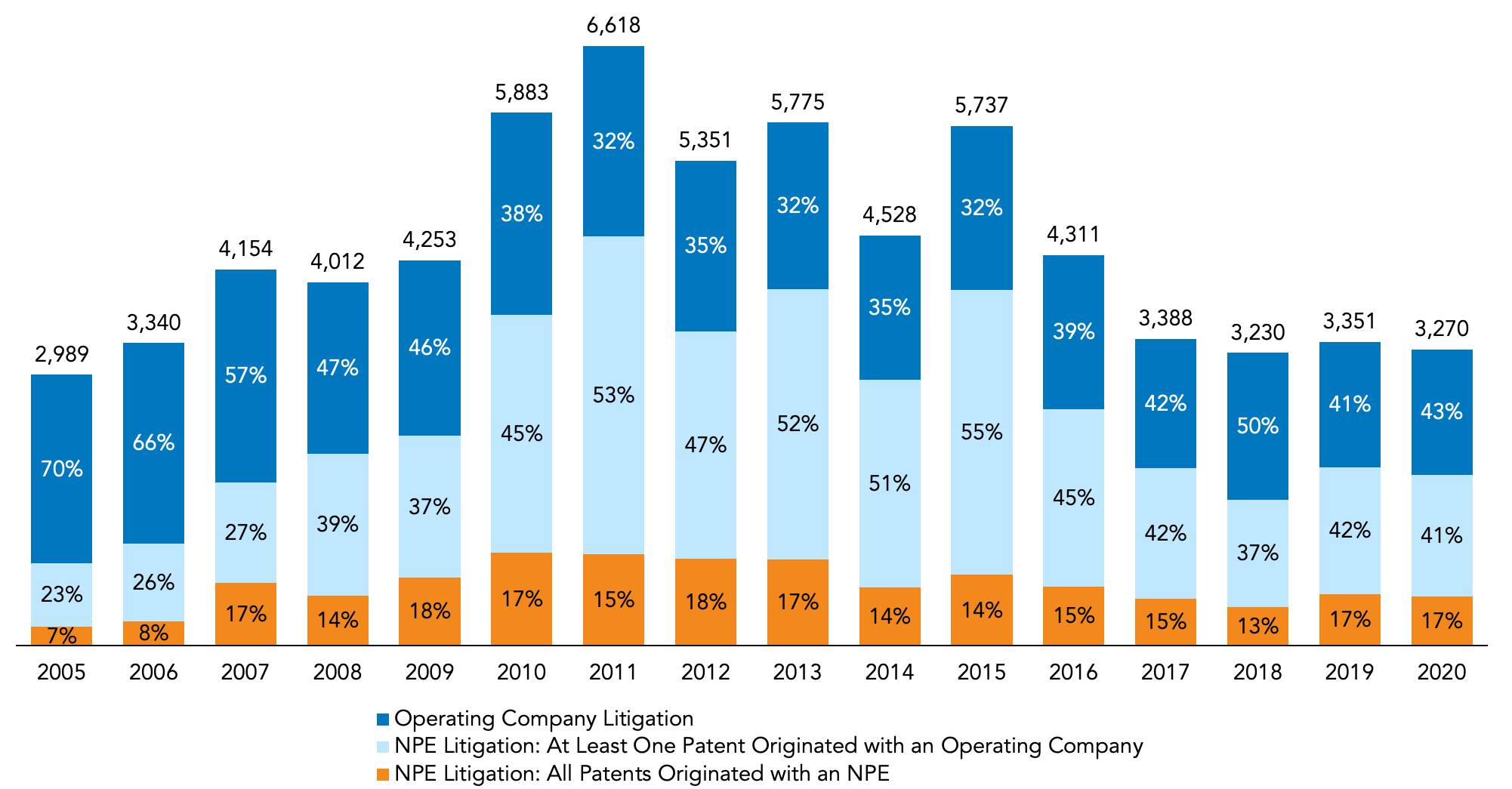

As illustrated in Figure 4, RPX analysis indicates that approximately 85% of the patent litigation filed each year since 2005 has involved operating company patents, with the vast majority of defendants sued by NPEs.

Figure 4. Defendants Added to District Court Litigation (by Defendant Start Year) Since 2005

The rise in third-party litigation finance has impacted the character of patent portfolios for monetization as well as settlement dynamics.

Since 2019, RPX has reported on the practices of a new breed of NPEs—one with sufficient resources to acquire relatively robust portfolios of patents for assertion in expensive, often multi-front, and potentially protracted enforcement campaigns. Now, with the litigation finance industry flush with capital amid the COVID-19 pandemic, and with a number of third-party backed campaigns maturing, the effects of litigation finance on the patent space are becoming apparent.

More Nonrecourse Funding and Due Diligence

Litigation funding is typically provided on a nonrecourse basis; that is, the funder collects a return on its investment only in the event of a successful outcome. If a funded plaintiff fails to recover in litigation, that plaintiff is generally not obligated to repay the funds advanced for the litigation. This model reduces the payout received by a successful litigant; however, it also significantly mitigates the financial risk that comes with filing litigation.

Given that a nonrecourse funding arrangement comes with the risk of a total loss for the investor, litigation funders spend substantial time and effort evaluating the patents for assertion. As litigation finance continues to permeate the patent space, the character of the assets asserted by third-party funded NPEs may reflect additional due diligence and portfolio selection.

Thus, while the number of patent disputes (measured by number of defendants added to litigation) may be below peak levels from 2011-2015, the economic risk to defendants may be the same—or even higher.

NPEs have faced a number of legal and legislative changes over the years reflected in the decline of litigation activity since the peak in 2011-2012. While some NPEs have left the patent monetization business altogether, many have adapted; and some are doubling down on patent litigation, this time in partnership with experienced litigation funders.

In response to past reforms and the due diligence of litigation funders, many of today’s NPEs appear to be focusing on the acquisition and assertion of larger and more robust patent portfolios. With the IP market flush with former operating company patents, and with third-party funding increasingly widespread, the economic risk of NPE litigation may be the same as it was when filings were at peak levels—or even higher.

RPX members interested in taking a closer look at the trends discussed in this article can view a related webinar, available on RPX Insight here.