IP Edge-Tied Plaintiffs Go Zero for Four in Petitions for Writs of Mandamus

Last month, for the first time in seven years, not a single complaint was filed in any US federal court by a plaintiff obviously tied to Texas patent monetization firm IP Edge LLC, which had previously established a regular pattern of filing roughly 50 patent complaints per month. The “Series of Extraordinary Events” unfolding first before Delaware Chief Judge Colm F. Connolly, but also at the Federal Circuit, would appear to have had more than a little to do with this abrupt pause. Multiple IP Edge-associated plaintiffs saw their Delaware cases land before Judge Connolly, leading to evidentiary hearings and subsequent production orders that triggered four of those plaintiffs to file petitions for writs of mandamus, some asking the Federal Circuit to halt those production orders and others, to vacate—as acts of judicial overreach—Judge Connolly’s standing orders regarding heightened disclosure of party ownership and certain third-party litigation funding. Having previously turned away two of those petitions, this past week the Federal Circuit batted away the second two, as premature, through a pair of nonprecedential orders noting that neither petitioner showed that the Delaware court “has taken any action . . . that is so far outside its authority to warrant the extraordinary remedy of a writ of mandamus”.

In denying the petitions of IP Edge-associated plaintiffs Creekview IP LLC and Waverly Licensing LLC, the Federal Circuit first lays out the standard by which such petitions are to be judged: “‘As the writ [of mandamus] is one of the most potent weapons in the judicial arsenal, three conditions must be satisfied before it may issue’: the petitioner must show (1) there is ‘no other adequate means to attain the relief he desires,’ (2) the ‘right to issuance of the writ is clear and indisputable,’ and (3) ‘the writ is appropriate under the circumstances” (internal citation omitted). The petitioners had directly challenged the entry of Judge Connolly’s standing orders in the first place, but they also argued that the Federal Circuit should step in because they had taken action before Judge Connolly to end the cases in which the court nevertheless continued to exercise authority over the parties (to hold evidentiary hearings and hand down production orders).

The Federal Circuit ruled that both requests are premature, indicating that the mandamus threshold that it had just laid out “has not been met”. As to the frontal attack on Judge Connolly’s standing orders, the court ruled that “a direct challenge to those orders at this juncture is premature, as Creekview has not been found to violate those orders, and it will have alternative adequate means to raise such challenges if, and when, such violations are found to occur”. The appellate court likewise ruled the request to step in and cut off Judge Connolly’s ongoing exercise of jurisdiction over the parties, the decision citing both the district court stay that has been in place, to await the outcome of mandamus proceedings, and the fact that “there is no absolute prohibition on a district court’s addressing collateral issues following a dismissal”.

The Creekview IP and Waverly Licensing opinions can be read here and here, respectively. Both mention the prior unsuccessful petition of sister IP Edge plaintiff Nimitz Technologies LLC, also deemed premature. There, Nimitz had not mounted a direct challenge to Judge Connolly’s authority to enter his two April 2022 standing orders regarding disclosure; rather, Nimitz asked the Federal Circuit to halt the production order that Judge Connolly issued after a pair of evidentiary hearings heightened his concerns over the compliance of Nimitz with those orders, as well as of the compliance of several other IP Edge plaintiffs (Backertop Licensing LLC, Lamplight Licensing LLC, and Mellaconic IP LLC) with them. (Yet another IP Edge-tied plaintiff, Swirlate IP LLC, filed the fourth petition for a writ of mandamus; it was earlier denied on procedural grounds.)

As RPX reported in detail last week, Nimitz has appealed the panel denial of its writ of mandamus to the full Federal Circuit, arguing, among other things, that full court consideration is necessary to “answer to a precedent-setting question of exceptional importance: whether the district court may require that a litigant provide attorney-client privileged documents to the judge that is investigating the party, where the crime-fraud exception to the attorney-client privilege has not been, and could not be, invoked”. That appeal remains underway.

Meanwhile, as noted, the IP Edge cases before Judge Connolly have all been stayed, as are cases raising similar questions for the court, but in connection with separate Texas monetization firm Dynamic IP Deals, LLC (d/b/a DynaIP). Evidentiary hearings were taken off calendar in those other cases, filed by DynaIP-tied plaintiffs Missed Call, LLC and SAFE IP LLC, as was a hearing in the suit filed by VLSI Technology LLC, an entity connected to global investment manager Fortress Investment Group LLC, against Intel. That last case, only the Delaware leg among the set of disputes between VLSI and Intel, has been dismissed pursuant to a stipulation presented to Judge Connolly involving a covenant not to sue (with related reporting here).

Apparently in light of this heavy judicial scrutiny of its historical monetization practices, the large number of plaintiffs connected to perennial top-filer IP Edge filed no new cases in December 2022, for the first time in seven years. The firm was formed as prior prolific monetization engine IP Navigation Group, LLC (d/b/a IPNav) wound down operations (details here). Having been the director and vice president of Asia for IPNav in 2012-2013, Lillian Woung created IP Edge with fellow Texas attorney Sanjay Pant and Illinois Gautham (Gau) Bodepudi (who also reports past work with IPNav), first in Nevada (in 2010) and later merging into Texas (in 2015). IP Edge has never filed suit itself but has, through its associated LLCs, been the top filer by volume of NPE litigation, both for the better part of a decade and by an order of magnitude.

As the dust settles on 2022, IP Edge appears to have once again remained atop the list of the most prolific NPEs for the year, and by a wide margin—but it will do so both without a single case filed in any federal district court at all this past December and without a single case filed in District of Delaware throughout the entire fourth quarter of the year.

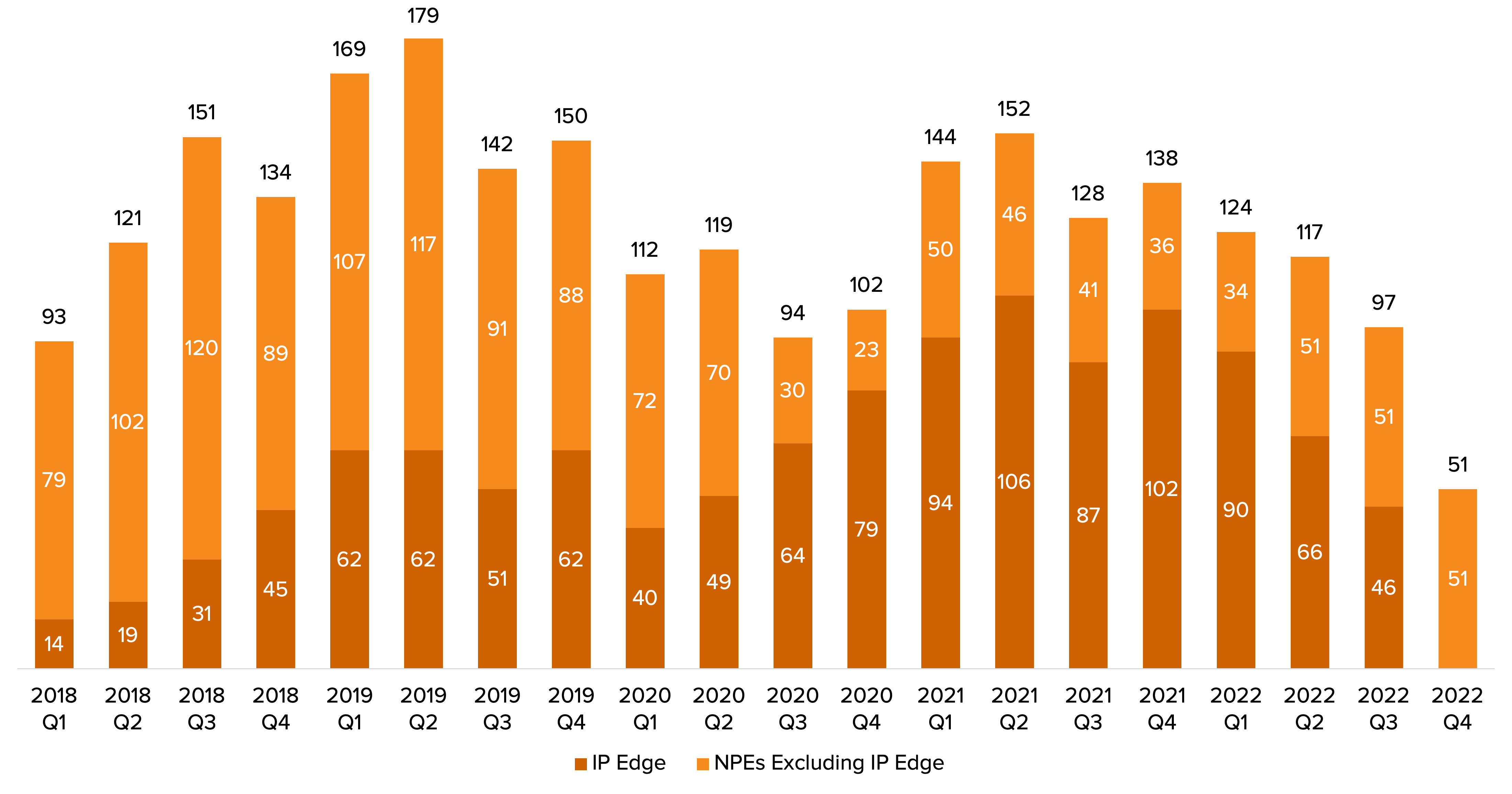

The result has been a dramatic dip for Delaware’s NPE numbers overall, as detailed in RPX’s upcoming review of the fourth quarter and 2022 overall. As illustrated below, IP Edge has accounted for the majority of all Delaware NPE litigation since Q3 2020, dropping off only in Q3 2022 (when Judge Connolly began pressuring the entities mentioned above). In the fourth quarter, during which IP Edge filed no new cases in Delaware at all, the district saw just 51 defendants added by other NPEs, a 62% drop from Q4 2021 (during which NPEs collectively added 138 defendants, at that point including IP Edge).

Defendants Added in Delaware by All NPEs, IP Edge, and Excluding IP Edge

Other, perhaps more organic, changes have been afoot at IP Edge as well, including the emergence in recent years of an “IP Edge 2.0”, marked by plaintiffs formed directly by Bodepudi, Pant, and Woung that then proceed to substantive litigation of the patents acquired (whereas IP Edge’s earlier strategy saw plaintiffs typically settle cases quickly, before any meaningful litigation). For details concerning those developments, see here. Also, in January 2022, Woung purportedly left IP Edge (which no longer lists her on its website) for a position as “Head of Industry Partnerships” at US Innovation Fund LLC (USIF), the website of which says that the entity “promotes, protects, and accelerates U.S. commercialization, job creation, and innovation by providing U.S. companies with access to IP rights and investment capital”. However, while the USIF website lists its management team as being comprised of executives not linked to other IP Edge entities (Kent S. Petty, Shaun McCabe, and Marios Kallis), Texas state records suggest an IP Edge connection, as its three managing members (as of August 16, 2022) are the familiar trio: Woung, Bodepudi, and Pant.

RPX has also noted that IP Edge last recorded the acquisition of new patents with the USPTO in July 2022 and that, while past practice had been to form new Texas LLCs at a brisk clip, several per month, IP Edge last created such a potential plaintiff in November 2022, apparently forming just the one.

The targets of IP Edge plaintiffs are not waiting to see what this pause of its usual activities will mean for its ongoing and/or potential new litigation matters. As covered here, several have deployed a declaratory judgment strategy for dealing with the firm’s assertion efforts.

For more on IP Edge, patent venue trends, and other key developments that shaped the patent assertion space last year, see RPX’s fourth-quarter review.